http://www.bbc.com/news/business-42695661

Carillion: Small firms count the cost of collapse

Thousands of small firms working for failed construction giant Carillion are waiting to learn if they will be paid, amid growing fears some could close.

Carillion used an extensive network of sub-contractors and local suppliers, paying them almost £1bn a year, according to its latest annual report.

Employers' groups are trying to assess the exposure of small firms, but said many faced financial hardship.

It comes as critics step up calls for a review into the Carillion crisis.

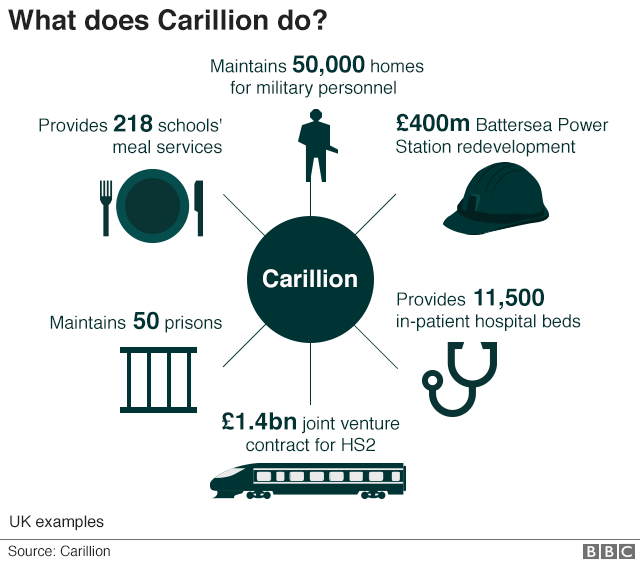

Carillion's work stretched from the HS2 rail project and military contracts to maintaining hospitals, schools, and prisons.

Although Cabinet Office Minister David Lidington said on Monday there would be government support for public sector contracts, those firms working on purely private sector deals would get only two days' support.

Carillion spent £952m with local suppliers in 2016 and used an extensive network of small firms because, it said, "we remain wholly committed to generating regional economic growth and development".

But the head of the Federation of Small Businesses said thousands of jobs and livelihoods were now at risk because those firms would be at the back of the queue for payment.

Mike Cherry said it was a situation made worse because Carillion extended its payment schedule to suppliers last year.

"These unpaid bills may well go back several months," he continued. "I wrote to Carillion back in July last year to express concern after hearing from FSB members that the company was making small suppliers wait 120 days to be paid."

A partner at one accountancy firm, who asked not to be named, said small firms were looking at total losses stretching into hundreds of millions of pounds.

"Asset sales won't even raise enough to cover the debts of senior bank creditors, so many small firms won't see a bean," he said.

Rudi Klein, head of Specialist Engineering Contractor, an umbrella group representing suppliers to the construction industry, said Carillion outsourced virtually all its work.

He said the government knew of Carillion's reliance on sub-contractors, but continued to award the company lucrative work despite growing concerns about its finances.

"It's that supply chain who is going to bear the massive loss," he said. "There could be a large number of firms that will experience substantial financial distress."

- 'They've literally locked the gate'

- Carillion: Not alone in hitting problems

- Where did it go wrong for Carillion?

- Soldiers to schools - Carillion in UK public life

- Carillion collapse: What next?

The boss of a Carillion sub-contractor, describing himself as Mike, in southern England, contacted the BBC with his own story.

"We've invoiced them for £240,000, going back to September last year. I don't think we'll get this money back.

"For us, it's a bad day, it'll impact us for the year. There are smaller contractors who will be impacted worse."

He added: "We've always been struggling with the Carillion culture... Their procurement people weren't good and we didn't like working for them."

Analysis: Dominic O'Connell, Today business presenter

Lightning seems to strike the same place remarkably often in Britain's construction and support services sectors.

For some, Carillion's demise will seem like a bolt from the blue. But look back 20 years and you find a surprising number of companies which struck similar problems, although not always with fatal consequences.

Amey, Jarvis, Connaught, Rok, G4S, Balfour Beatty, Serco, Mitie - and many others - have had to own up to accounts that were, to use a euphemism, optimistic. Most lived to fight another day. Carillion did not.

Talk to executives in the industry and they easily find the common thread. Companies that are built up quickly through acquisitions, as Carillion was from the combination of Tarmac, Wimpey, Mowlem and Alfred McAlpine - have an extra struggle first to understand then to integrate their disparate activities.

Industry experts spoken to by the BBC also think that Carillion overpaid for its acquisitions, leaving it with less financial fat to fall back on when the going got tough.

All the companies above were hurt by what turned out to be aggressive accounting.

On Monday, Mr Lidington said the government was stepping in to pay employees and small businesses working on Carillion's public contracts and assess the distribution of work among other companies.

However, companies working on private projects will get no such support.

Accountancy firm PwC, which is overseeing Carillion's liquidation, said in a statement: "Unless told otherwise, all employees, agents and subcontractors are being asked to continue to work as normal and they will be paid for the work they do during the liquidations."

But there were anecdotal reports that work had stopped on many projects.

A bricklayer on the new £350m Midland Metropolitan Hospital building, Philip Ellis, told the BBC that when workers turned up on Monday they were told to go home.

He said: "About 20 of us working for our sub-contractor were told we could go on-site to collect equipment, but that was it.... I spent the day phoning recruitment agencies looking for work - but was told everyone's doing that."

'Watershed'

Ministers held an emergency meeting on Monday evening to discuss the impact of Carillion's demise on public services.

Mr Lidington said after the meeting that "people were turning up to work [and] we have not had any reports of serious interruption to service delivery".

But it comes amid growing calls for a review of the way government hands out public contracts.

Labour leader Jeremy Corbyn accused ministers of "shocking negligence", and said Carillion's crisis was a "watershed moment" for the "outsource first dogma" that had "fleeced the public".

Mr Lidington's Cabinet Office office Oliver Dowden said the government had put in place "contingency measures" when concerns were raised about Carillion.

"The principle contingency measure we took was to ensure that all new contracts were joint venture contracts," he told the BBC. "That means the risk is shared with other companies and on those contracts, they continue to be delivered."

There is also mounting criticism of the pay packages enjoyed by directors in the run-up to Carillion's crisis.

Former chief executive Richard Howson, in charged until last year when Carillion issued the first of three shock profit warnings, will continue to be paid until October.

Mr Lidington told the Commons on Monday that the official receiver had the power to impose penalties if it uncovered any misconduct.

沒有留言:

張貼留言